Relocating from New Zealand to Australia offers exciting opportunities, but it also comes with important financial and legal considerations, including understanding how the Australian tax system works. For New Zealanders planning a move across the Tasman, getting ahead of your tax obligations can make a real difference to your peace of mind and financial success. This guide outlines the basics of Australian taxation to help you settle in with clarity and confidence.

How the Australian Tax System Works

Australia operates a progressive tax system, where your tax rate increases as your income rises. The Australian Taxation Office (ATO) is the authority responsible for administering tax laws, collecting taxes, and enforcing compliance.

One of the key things to understand is the concept of tax residency rules. Even if you’re not an Australian citizen, you may be considered an Australian tax resident if you live in the country for more than six months, establish a home there, or earn income while residing locally. Being classified as a resident for tax purposes means your worldwide income becomes taxable in Australia, not just what you earn locally.

Do New Zealanders Need a Tax File Number (TFN)?

Yes. Anyone working or earning income in Australia, including New Zealanders working in Australia, needs a Tax File Number (TFN). This unique identifier is required when starting a job, opening a bank account, or lodging a tax return. Without it, you may be taxed at the highest marginal rate.

Applying for a TFN is straightforward and free. Most new arrivals can apply online through the ATO website or visit an Australia Post office with proof of identity.

Income Tax Rates in Australia Explained

Australian income tax is levied at marginal rates, depending on your annual income. As of the 2023–24 financial year, the basic tax brackets for residents are:

- $0 – $18,200: Tax-free

- $18,201 – $45,000: 19%

- $45,001 – $120,000: 32.5%

- $120,001 – $180,000: 37%

- Over $180,000: 45%

These figures are updated periodically by the ATO, so it’s important to refer to current rates when doing your financial planning for relocation. If you are deemed a non-resident for tax purposes, different (and generally higher) rates apply.

What Happens to Your KiwiSaver and NZ Investments?

KiwiSaver is a New Zealand-based retirement savings scheme, but if you’re relocating permanently to Australia, you may be able to transfer your savings under the Trans-Tasman Portability Arrangement. This allows eligible individuals to move their KiwiSaver funds to a participating Australian superannuation scheme. However, not all Australian funds accept transfers, so it’s important to confirm with your chosen provider before initiating the process.

Transferred funds are locked into Australia’s retirement system, meaning you generally cannot access them until you meet the Australian superannuation release conditions, such as reaching preservation age or retiring.

If you maintain KiwiSaver or other investment income in New Zealand while living abroad, be aware of potential cross-border tax obligations. The double taxation agreement between New Zealand and Australia helps ensure you’re not taxed twice on the same income. Even so, seeking tailored expat tax advice is strongly recommended if you have dual financial interests, as reporting obligations may vary depending on residency and income type.

Superannuation: Australia’s Retirement Savings System

Instead of KiwiSaver, Australia has its own retirement scheme called superannuation. Employers are required to contribute 11% (as of 2023) of your ordinary earnings into a superannuation fund on your behalf.

While superannuation has a purpose similar to KiwiSaver, the systems are not directly compatible. If you’re moving to Australia from New Zealand for the long term, you’ll begin building your retirement savings through super rather than KiwiSaver. It’s important to choose a superannuation provider and review the fund’s fees, performance, and insurance features.

Important Tax Obligations for New Arrivals

Upon becoming a tax resident in Australia, you are responsible for:

- Filing a tax return in Australia each year (typically due by 31 October for the previous financial year)

- Declaring global income, including rental income, dividends, and overseas salaries

- Paying the Medicare Levy, which is 2% of your taxable income (unless exempt)

- Keeping records of all income, deductions, and tax payments

The first year of tax residency can be complex, especially if you’re transitioning income sources between two countries. Seeking guidance on Australian tax rates and how they apply to your unique situation can help you avoid unexpected issues.

Tips for Managing Your Finances When You Move to Australia

Here are a few simple but powerful steps you can take to stay on top of your taxes when relocating:

- Apply for your TFN immediately upon arrival.

- Open an Australian bank account before starting employment.

- Maintain clear records of any income earned in New Zealand during the transition.

- Understand your superannuation in Australia and choose a provider that aligns with your goals.

- If you’re unsure, consult a tax adviser familiar with KiwiSaver and Australian tax crossover issues.

If you’re in the early stages of your move to Australia from New Zealand, getting a handle on the tax system is just one piece of the puzzle.

Ready to Take the Next Step?

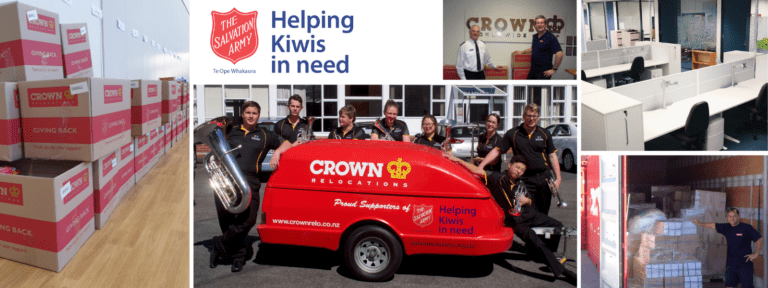

Understanding the tax system is a key part of relocating but so is managing the logistics. Whether you’re moving for work, study, or family reasons, Crown Relocations NZ offers expert assistance every step of the way. From careful planning to secure transport, they help make your transition seamless. Start with your move to Australia from New Zealand or get a free online moving quote from Crown and take the first step with confidence.